Fact-based monitoring & reports

In today's business climate, it is crucial to embrace Industry 4.0 to optimize production. By continuously monitoring our systems, we gain real-time insights for goal tracking and fact-based decisions.

Our monitoring solution with a focus on media is fully adapted to operate within the framework of Industry 4.0.

By using the latest technology to monitor and optimize our production processes, we are positioning ourselves for a future where agile, adaptable and sustainable business models are the key to success.

Effective Target Follow-up

Monitoring with real-time collection and analysis gives us the opportunity to quickly adapt changes by following up and evaluating business goals in real time.

Fact-Based Decisions

Continuous monitoring provides reliable data, enabling informed and rapid decisions to optimize operations

Sustainable production

By integrating IoT and AI, we create sustainable production and optimize energy consumption

Start by reducing your compressed air?

Our expertise guide you through the process from start to excellence!

CO2 FOOTPRINT

Leakage management will reduce your carbon footprint and contribute to the global goals of sustainable development.

LEAKS >25%

Compressed air systems often have leakage levels above 25-30%. Leakage should be less than 10% in a well-maintained system.

FACT BASED

Monitoring for fact based and better decision making. Get control, follow up on your targets, reduce costs and increase efficiency in your operations.

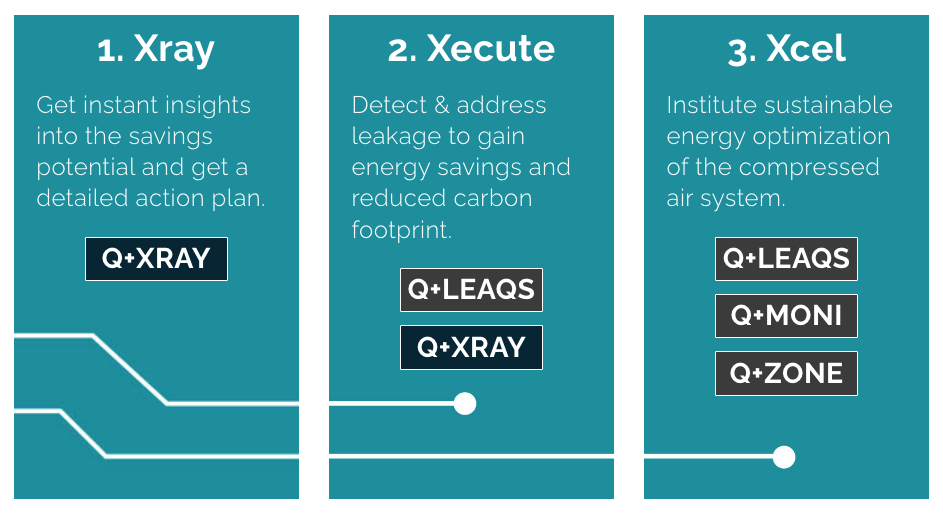

3-step process towards energy excellence in your industry

The cheapest and fastest way to reduce the carbon footprint of your industrial compressed air system is to reduce leakage.

Begin with an audit of your system already today, ROI is less than 1 year!

How we impact our Customers

average compressor capacity

average savings annually

average yearly CO2e reduction

Our Partners

Save energy with our eBook

Globally, Enersize sees a strong focus on sustainability, public demand for energy certifications and digital transformation as the main trends driving energy optimization of industrial compressed air systems. This is what underpins our product innovation.

Reduce your carbon footprint. Reduce compressed air leakage.

The cheapest and fastest way to reduce the carbon footprint of your industrial compressed air system is to reduce leakage.